Invoices, invoices, invoices…

Making a payment from SAP… That’s what majority of SAP Finance consultants know how to customize. If you do not, there is a solid section of e-book FREEQUENTLY ASKED QUESTIONS ON SAP FINANCE telling you about different nuances of this setup.

However, most SAP Finance consultants think about payment as about vendor payment. This implies the existence of vendor master record, invoice and so on.

Charles Olaosebikan tells us about yet another option to make payments: Payment Requests. They do not require invoice or even master record to exist.

Making manual payments against General Ledger Accounts or non SAP vendors can be a challenging business process in SAP. SAP has provided the one time vendor account group for this but sometimes this is not adequate to meet the business requirements.

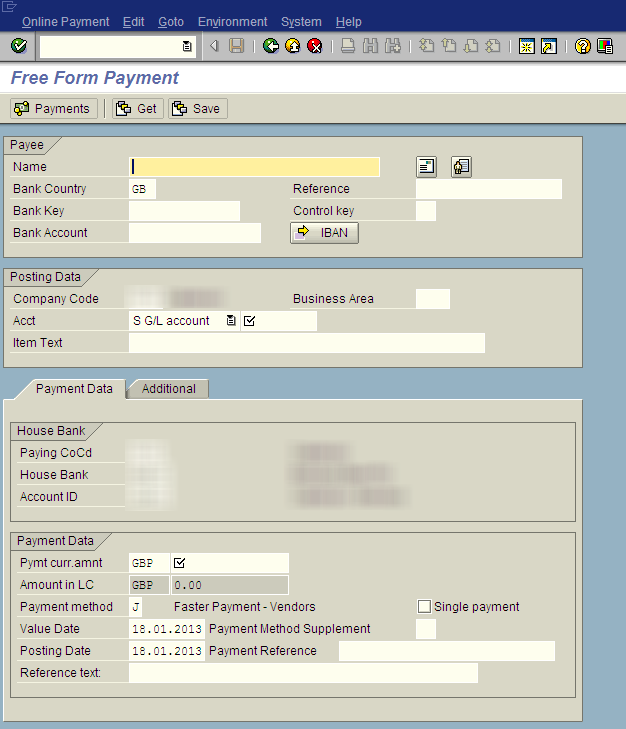

The free form payment in transaction RVND can be useful in this case to fulfil gaps that may exist in the standard payment processes.

Free-form payment transaction

You can create payment requests from the FI-BL application to allow posting into GL accounts and subsequently create payment files using the automatic payment transactions for payment request F111. The payment request can be dual controlled to allow for a second user to check the payment and release it.

An approved or rejected payment request is saved in the system. From a technical viewpoint there is no difference between a rejected payment request and one which has not yet been approved. For both, the Released field in the document header is empty.

As long as a payment request is not approved, then it can be changed. If you change a complete payment request, the “Complete” indicator is reset: If a payment request created in the system has no prospect of approval, you can delete it from the system.

When a payment request is generated, the payment data (payment amounts and due dates) is already known. This data is expected by the payment program, which does not support due date calculation and cash discount processing.

If you make a payment via a G/L account, you must specify all the data relevant for the payment in the payment request. If you make a payment via customer or vendor account, you can let the payment program determine the payment control parameters, the payment method, and the bank details.

You can define the following payment data in the payment request:

- Payer (company code)

- Payment amounts and currencies (in local currency, document currency, and payment currency)

- Business partner (customer, vendor, or G/L account)

- Address data of the business partner and the payment recipient (alternative payment recipient and branch)

- Bank data of the payment recipient and the house bank, and possible payment procedures

- Other correspondence banks and intermediate banks

- Due dates and value dates (the system uses the value date of the receiving bank to calculate the value date of the house bank)

Have you used the Payment Request functionality in your projects? What were the benefits and shortfalls of it?

If you want to know more about Payment Requests, why not visit the page You Need Our Help?